After announcing in the deck that it was true Warren saw the financial crisis coming, PolitiFact did what it does on occasion: It gave us a fact check that offered hardly any evidence in support of its conclusion.

Having written about this some on Twitter and Facebook already, I can tell our readers that some liberals aren't going to want to admit that Warren claimed she saw a particular crisis coming. But the crisis she supposedly foresaw wasn't merely a crisis for some number of subprime borrowers facing foreclosure. It wasn't just a crisis of predatory lenders preying on people.

It was the crisis that saw many banks failing, lenders not lending and millions losing their jobs.

PolitiFact left no doubt it understood Warren was saying she foresaw that particular crisis, leading with the following:

Democratic Sen. Elizabeth Warren warned about the financial crisis of the 2000s before it happened, she claimed during a CNN town hall where she pitched herself as the best option for president in the 2020 election.PolitiFact provided no reasonable evidence to show Warren saw that crisis coming. But it still somehow reached the conclusion it was true Warren saw the 2008 financial crisis coming.

We'll review the evidence PolitiFact quoted, the evidence PolitiFact linked and finally look at evidence PolitiFact did not bother to mention.

Sifting the Would-be Evidence

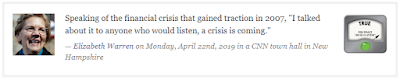

We start with PolitiFact's presentation of Warren's claim (bold emphasis added):Warren, a former Harvard Law School professor, told an audience of college students that her whole life’s work has been "about what's happening to working families.Warren said she saw a crisis coming. It was the one that hit in 2007, 2008 and "just took us down." She supposedly saw that coming.

"And starting in the early 2000s, the crisis was coming. I was waving my arms, ringing the bell, doing everything I could. I said families are getting cheated all over this country," Warren said April 22 in Manchester, N.H. "It started when the mortgage companies targeted communities of color. They targeted seniors. They targeted Latinos. They came in and sold the worst possible mortgages and stripped wealth out of those communities, and then took those products across the nation. I went everywhere I could. I talked about it to anyone who would listen, a crisis is coming."

But nobody wanted to listen, Warren said, "so the crisis hit in 2007, 2008, and just took us down."

The next paragraph from PolitiFact constitutes a non-sequitur (logical fallacy) that characterizes the whole of the fact check:

We confirmed that Warren did raise the alarm about the looming housing and financial crisis. She spoke about debt, financial lending practices and other factors affecting families and the economy years before the financial crisis peaked in 2008.Does talking about debt, lending practices and other factors affecting the economy and families mean that one has raised the alarm about a looming financial crisis? We say it doesn't unless one says something specific about a looming financial crisis that suitably matches the one we had in 2008.

This cupboard is bare.

We'll hunt through every quotation PolitiFact used and survey every article PolitiFact linked in support of Warren. We cannot quote these sources exhaustively because of copyright issues. But we'll give our readers far more than PolitiFact gave its readers.PolitiFact:

Warren’s presidential campaign cited several blog posts and comments to media outlets in 2005 and 2006, and Warren’s 2003 book, "The Two-Income Trap," co-authored with her daughter, Amelia Warren Tyagi, as examples of Warren warning about subprime lending and an imminent housing crisis.PolitiFact does not quote from the listed blog posts (we'll get to those later). Instead PolitiFact leads its presentation of evidence with a quotation from the book it mentions in the same paragraph:

"In the overwhelming majority of cases, subprime lenders prey on families that already own their own homes, rather than expanding access to new homeowners. Fully 80 percent of subprime mortgages involve refinancing loans for families that already own their homes," Warren said in the book. "For these families, subprime lending does nothing more than increase the family's housing costs, taking resources away from other investments and increasing the chances that the family will lose its home if anything goes wrong."There is no warning of any crisis in that paragraph. There's a warning about borrowing money from the more expensive subprime market. But that warning makes sense regardless of the possibility of an impending financial crisis.

At the risk of understatement, we find PolitiFact's Exhibit A in support of Warren's claim underwhelming.

For Exhibit B, PolitiFact trotted forth part of a 2004 PBS interview:

"I think what the landscape shows is the middle class is under assault in a way that has not happened before in our history," Warren said. "Stagnant wages, rising costs, wildly rising debt. It's in everyone's interest to turn that back around."Again, there is no warning of any crisis resembling the 2008 financial crisis. Instead, Warren bemoans the fact that the middle class is supposedly under assault. She mentions wages, costs and debt but doesn't tie them together into any type of specific threat.

PolitiFact cited The New York Times as its Exhibit C:

Professor Warren of Harvard believes that disaster lurks as homeowners borrow against their homes to forestall bankruptcy. When the stock market tumbled five years ago, people in trouble could sell stocks to stay afloat, she said. But home equity doesn't work the same way. As she put it, "You can't sell a part of your home like you could a stock in the stock market bubble."Like the two preceding exhibits, Exhibit C does not offer any warning of a crisis, unless we count the personal crisis faced by homeowners facing foreclosure. That is the subject of the article and the group facing lurking disaster. The article's kicker quote--from Warren--helps cinch the case.

PolitiFact's Exhibit D consists of comments from a representative of the conservative Housing Center at the American Enterprise Institute.

How did co-director Ed Pinto support Warren's claim that she saw the financial crisis coming?

PolitiFact:

Warren was "substantially correct" in her assessment that home prices were going up rapidly relative to incomes (particularly for households with a one wage earner), said Ed Pinto, co-director of the Housing Center at the American Enterprise Institute, a conservative think tank.If Warren was right that home prices were going up rapidly compared to incomes then that means there was an impending crisis? One that matches the financial crisis of 2008?

Please, where is the logic (and wouldn't we love to see the interview questions PolitiFact posed to the experts it cited!)?

With its Exhibit E, PolitiFact teases us with a subheader designed to foster (false) hope: "Consumer advocate groups credit Warren for alerting about the crisis"

Now we're getting somewhere?

PolitiFact:

"I remember (Warren) talking about credit card abuses and how they were harming families," [Deborah] Goldstein said. "People were using credit to manage basic daily expenses."Summing up, we have a secondary source--an interest group that agrees with Warren--saying it was concerned about an imminent financial crisis and "communicated with Warren on what could be done about it."

Goldstein said that her group, also concerned about the imminent financial crisis, in the early 2000s communicated with Warren on what could be done about it.

PolitiFact offers nothing from the Center for Responsible Lending that supports its subheader.

Exhibit F gives us yet another empty endorsement of Warren:

"I'd give then-professor Warren the credit for banging the drum and ringing the bell early on unfair financial practices," said Ed Mierzwinski, senior director of the Federal Consumer Program at the U.S. Public Interest Research Group. Warren was the "No. 1 go-to academic expert" in the mid-to-late '90s and 2000s in the debate over changes to the bankruptcy code, he said.Credit where it's due: If "banging the drum and ringing the bell early on unfair financial practices" was the same as "banging the drum and ringing the bell early on the 2008 financial crisis" then we'd have something. Hearsay, perhaps, lacking documented evidence in support, but at least hearsay would be something.

Exhibits A-F add up to nothing.

PolitiFact goes on to list some of Warren's accomplishments, as though its list somehow contributes to the case that Warren warned about the 2008 financial crisis (we don't see it).

Quoting the unquoted Warren

PolitiFact used a number of hotlinks, presenting them as though they support Warren's claim but without quoting from them (and most often not even paraphrasing or summarizing them).We'll go through them in the order PolitiFact used them.

Talking Points Memo: "Is Housing More Affordable?"

Sen. Warren wrote a short blog post on Dec. 12, 2005 criticizing an article on home mortgages by David Leonhardt. Warren appeared to dispute Leonhardt's too-rosy picture of housing affordability.

We don't see anything reasonably taken as a warning about a future national financial crisis. It's hard to even pick out a quotation carrying a hint of that suggestion (please read it for yourself, link above).

(B)y picking the reference point as the early 1980s rather than the 1970s or the late 1980s, the NYT is benchmarking off the worst housing market in the second half of the 20th Century. Because inflation was out of control and mortgage rates were stratospheric, home buying was curtailed and housing markets suffered. Is that what we want to hold up as the model for comparison?We find Warren's presentation well short of apocalyptic.

Talking Points Memo: "Middle Matters"

The next link, from May 26, 2005, leads to an even shorter four paragraph blog entry. Warren warns about pressure on the middle class:

The middle class is being carved up as the main dish in a corporate feast. Strugging with flat incomes and rising costs for housing, health care, transportation, child care and taxes (yes, taxes), these folks are under a lot of financial strain. And big corporate interests, led by the consumer finance industry, are devouring families and spitting out the bones.Warning that the middle class may not always be with us thanks to a smorgasbord of costs serves as a weak foreshadowing of an impending financial crisis. Indeed, that crisis threatened some of the entities Warren blamed for pressuring the middle class.

Talking Points Memo: "Is Housing More Affordable?"

The third blog post PolitiFact linked was the same as the first.

PolitiFact's sidebar source list links three blog posts from Talking Points Memo but the text of the fact check contains three hotlinks referring to "several blog posts."

We'll take this space to note that the titles Warren chose for her blog posts seem pretty tame if she's going all out to warn people about an impending financial crisis ("I went everywhere I could. I talked about it to anyone who would listen, a crisis is coming.")

Talking Points Memo: "Foreclosures Up, Mortgage Brokers Keep on Selling"

The fourth link (third blog post), from April 21, 2006, did contain a warning. It noted that home foreclosures were up and suggested the housing bubble nationally was perhaps close to popping:

So why aren’t the mortgage lenders cutting back now? The problem, says my friend, is that no single bank or investment house owns those mortgages any more. They have passed them along to huge securitized pools, held in diverse ownership. That means a lot less oversight to be sure the big picture on lending makes any sense. And besides, the Army keeps on offering high returns, at least in the short run.Note: Warren used "Army" in her post to describe the abundance of mortgage sellers.

Nationally foreclosures are up 7% this quarter. That’s well behind Boston’s big numbers, but Boston was a leader during the boom. Will it now lead in the bust?

Housing bubbles that burst do not routinely lead to the financial crisis of 2008 (or similar ones). As for the lending market making sense, it likely would have made more sense in the early 2000s if Republicans and Democrats alike had resisted the temptation to interfere in those markets by pushing and incentivizing lax lending standards. Government regulation was one of the problems leading to the crisis.

Note to Sen. Warren: If you're trying your best to warn people about an impending crisis, try emphasizing that idea in the titles you choose for your articles warning about the impending crisis, like "Impending Crisis Looms" or something like that. The technique makes it look like it's an idea you're trying to emphasize.

Judgment on PolitiFact

PolitiFact used quotations from Warren that did not support her claim to justify calling her claim "True." We think that speaks to PolitiFact's incompetence and secondarily to PolitiFact's leftward tilt.Judgment on Sen. Warren

Thanks to a commenter at PolitiFact's Facebook page, we found stronger evidence supporting Warren's claim than PolitiFact was able to find. The commenter recalled seeing Warren on PBS sounding some kind of warning. When we found a search result from before 2008 we reviewed the text of an interview with Warren. The last line from Warren was exactly the type of evidence needed to find some truth in her claim:But they don't see an economic threat to the banks from these massive bankruptcies?Based on this answer alone, we think Warren could reasonably receive a "Half True" rating. She described a risk of mass foreclosures that would threaten banks. That's short of describing the extent of the 2008 financial crisis, but at least she described one of the basic elements that helped lead to that crisis.

Right now, they think that everyone can keep feeding and that there are still plenty of families to gobble up before they all head over the cliff, financially. But I have to tell you, the numbers are worrisome.

On the other hand, we saw little in the historical record to justify Warren's claim that she vigorously tried to broadcast a warning about an impending national financial crisis.

Perhaps Warren made other statements that would reasonably support her claim. But PolitiFact's fact check was our focus. It was mostly an accident that we did a better job than PolitiFact at finding evidence supporting Warren.

No comments:

Post a Comment

Thanks to commenters who refuse to honor various requests from the blog administrators, all comments are now moderated. Pseudonymous commenters who do not choose distinctive pseudonyms will not be published, period. No "Anonymous." No "Unknown." Etc.